Contributions to pension, provident and retirement annuity funds

With effect 1 March 2016 the tax deduction for contributions made to pension funds, provident funds and retirement annuity funds is significantly amended.

Please refer to previous year’s tax guides for the tax treatment before 1 March 2016. From 1 March 2016 onwards, the tax deduction calculation for the three different funds, pension, provident and retirement annuity funds will be identical.

The deduction will be limited to:

The above deduction is however limited to taxable income before this deduction and before any taxable capital gain.

Excess contributions not allowed as deductions are carried forward to the following year of assessment. Contributions made by employers on behalf of employees would be a taxable fringe benefit in the hands of the employees but will also be regarded as a contribution made by the employee, therefore deductible in the hands of the employee subject to the above limitations.

Medical and disability expenses

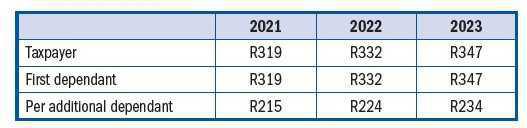

All taxpayers are entitled to a monthly “tax rebate” (i.e. credit) in respect of any medical scheme contributions made for the benefit of themselves and their dependants as follows:

For additional (e.g. out-of-pocket) medical expenses incurred by individual taxpayers, a tax rebate is available as follows:

- Where the taxpayer is 65 and older or where the taxpayer, taxpayer’s spouse or child is a person with a disability: 33.3% of the value of the amount by which the aggregate of the medical scheme fees that exceed 3 × the standard medical scheme credits, and all qualifying medical expenses (other than medical scheme contributions)

- Other taxpayers: 25% of the value of the amount by which the aggregate of the medical scheme fees that exceed 4× the standard medical scheme credits, and all qualifying medical expenses (other than medical scheme contributions), exceed 7.5% of the taxpayer’s taxable income (excluding any retirement fund lump sum benefit, retirement fund lump sum withdrawal benefit and severance benefit including capital gains)