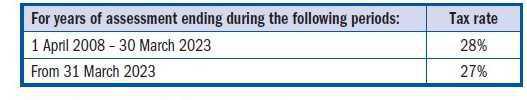

Resident companies (excluding personal service provider)

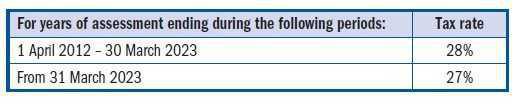

Non-resident companies/Branch profits

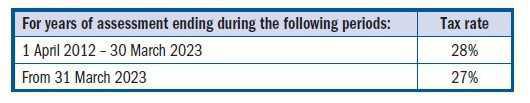

Personal service provider companies

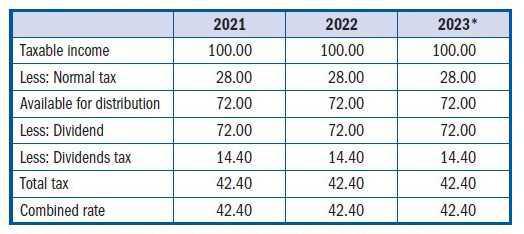

Combined tax rate of resident company (as a percentage)

Note: Dividends Tax is the liability of the shareholder, while the normal tax is a company liability.

* For tax years ending on or after 31 March 2023 the tax rate is reduced to 27%