Resident companies, non-resident companies/branch profits and personal service providers

Assessed losses of companies

The balance of assessed loss of a company, carried forward from a previous year of assessment, to be set-off against trading income of a current year of assessment, will be limited to the greater of:

- R1 million, and

- 80% of taxable income before taking into account any assessed loss.

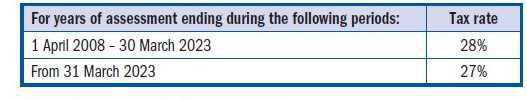

Combined tax rate of resident company (as a percentage)

Note: Dividends Tax is the liability of the shareholder, while the normal tax is a company liability.

* For tax years ending on or after 31 March 2023 the tax rate is reduced to 27%